It started late last year, gradually building up to a conversation I am now having 10 to 15 times a week.

Some crypto startup will approach Headline Media to gauge our interest in doing their PR. Our response is always the same: We appreciate your interest, but we don’t do ICOs.

“What? Wait, we aren’t like the other companies…”

“Sorry, we aren’t interested, but I can gladly refer---”

“But it’s not an ICO, it’s a private offering for accredited investors outside the Unit-.”

Many competitors and colleagues say we are foolish to miss out on the biggest cash cow to hit the industry since Indiegogo and other crowdsourcing schemes, which for the record, we avoided like the plague.

Our reasoning wasn’t altruistic. Beyond the fact that we wanted no part in misinforming unwitting investors, hyping questionable startups damages our reputation with journalists, and ultimately undermines the real achievements of the Israeli innovation story.

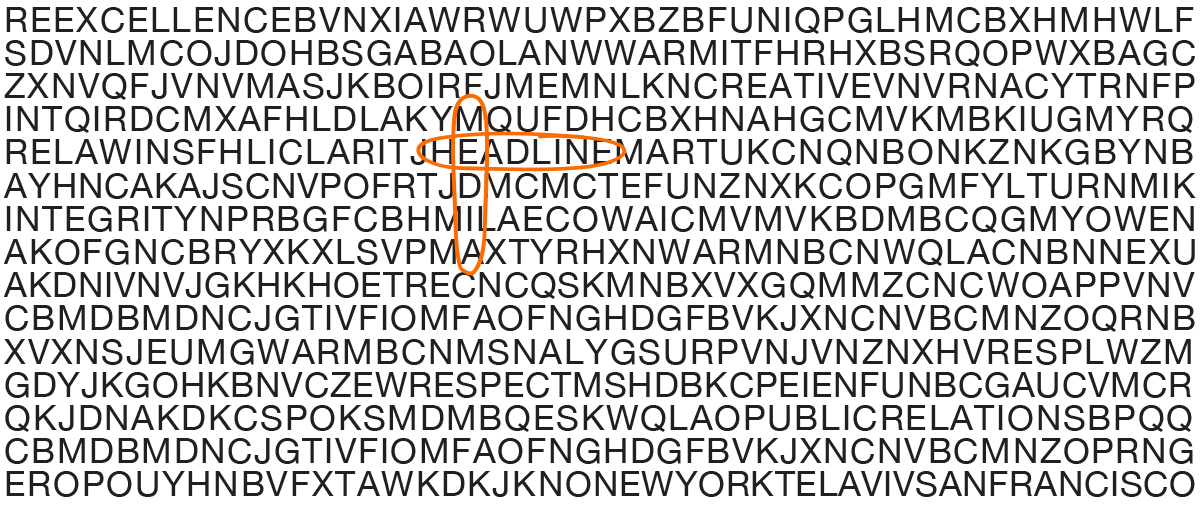

My co-founders, both former journalists, founded Headline Media 7 years ago in response to the explosion of incredible technology being produced in Israel, and the lack of marketing support to match the ecosystem’s R & D prowess. What emerged was a “journalist-driven shop,” meaning a handpicked portfolio consisting of amazing companies that have strong technological underpinnings, market leading aspirations, and most important of all, stories which resonate with journalists. In short, we would only take on stories that we, as journalists, would find newsworthy and of interest to the public. Due to the near endless supply of amazing companies in the ecosystem, our firm flourished. We, like the journalists that cover the Israeli tech ecosystem, felt like kids in a candy store.

When the ICO phenomenon emerged, it was indeed initially a relevant and exciting news story. Amazing innovators in the space were driving much needed public discussions on alternative sources of funding, safety and oversight in multiple industries, and even a new and secure future for the global financial system.

But very soon to follow was the emergence of dubious ICOs, too numerous to mention, that were the death knell of the end of any mainstream biz-tech media support for the space. As bitcoin price watching got old, journalists rightly argued that they had a responsibility to protect the public, and ultimately, many lost trust in the space. Like most of us, they had a hard time smelling the lone rose growing in the field of cow manure.

As the mainstream biz-tech outlets checked out, the social media giants such as Twitter, Facebook and Google followed suit, banning all ICO ads. Again, it wasn’t about altruism, it was about public responsibility and self- preservation.

Within the PR landscape you could find the good, the bad and the ugly. John Biggs, a reporter for TechCrunch, Entrepreneur and founder of TokenReporter.co recently wrote a scathing piece in Hackernoon, arguing PR buyer beware:

“What’s happening is a perfect storm of PR ruination. PR people, especially older folks who feel they’ve been left out of the startup revolution, are pitching themselves as the best in the business. They’re actively searching out ICO projects after having poor to middling track records with startup PR and communications. They’re also charging a huge premium because they know you’re desperate. Don’t fall for their lies. They will never get you into the WSJ or the New York Times; you’ll never hit the front of TechCrunch and getting onto the enthusiast sites like Reddit is useless for you.”

Inevitably a slew of questionable “media outlets” emerged specializing in the space and offering “pay per placement” coverage. These blogs read more like a horse betting guide you pick up at the track than a credible newspaper. Their raison d’etre: to profit from the precarious need of PR firms to help ICOs hype their offering to the least informed of investors.

Needless to say, we didn’t want any part of the ICO windfall. We got into this business in order to help amazing companies share their story with the world, and to showcase Israeli innovation on its best day.

Great PR, be it for cyber, mobility or even crypto, is about showcasing value. Having worked with almost 200 companies, helping dozens of clients establish market leadership, exit, get acquired, or go public, cemented for us that the companies that generate a tremendous degree of media momentum are those that have a true value proposition. If you showcase the value to the press, they will write about it. Again and again.

Given these dynamics, we expect cryptocurrencies to come under heightened regulatory scrutiny over the coming years, with unpredictable consequences for the sector. Of course, we’ve taken on clients who unabashedly seek to update regulatory frameworks – but there’s a big difference between that approach and trying to poke holes in regulations, or evade them altogether.

Meanwhile at Headline Media, we will continue to wake up every day eager to help our clients do big, transformative things. We’re in it to give the companies we represent the tools they need to make history – not just build hype.